How to Improve Your Account Security: Best Practices for 2024

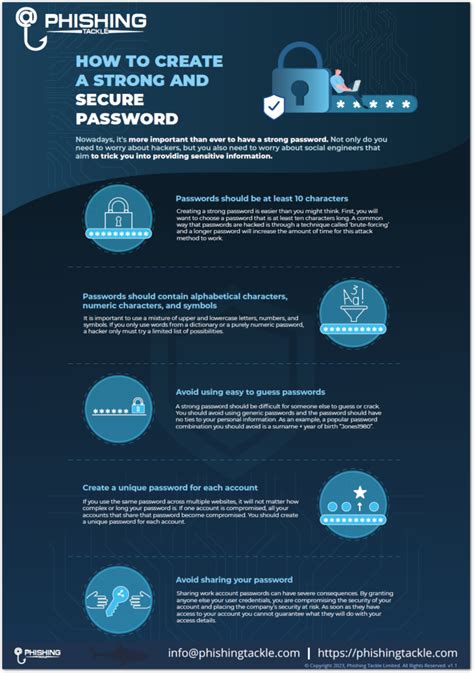

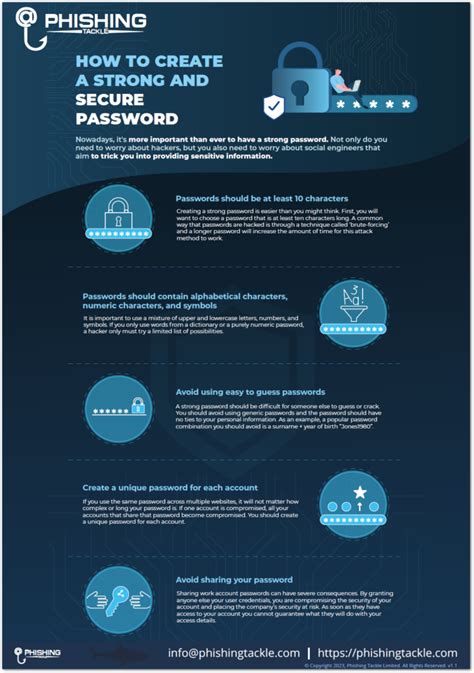

1. What Are the Best Password Practices for Account Security?

Creating a secure password is the first step to safeguarding your online accounts. Follow these best practices for strong passwords:

Key Password Tips:

- Use Complexity: A good password includes uppercase, lowercase, numbers, and symbols.

- Go for Length: Longer passwords are harder to crack, with 12–16 characters being ideal.

- Don’t Reuse Passwords: Each account should have a unique password to limit breach risks.

| Password Strategy | Effectiveness | Best Practices |

|---|---|---|

| Complexity | High | Include symbols and numbers |

| Length | Medium | 12-16 characters minimum |

| Uniqueness | High | Never reuse passwords across accounts |

2. How Does Two-Factor Authentication Enhance Security?

Two-Factor Authentication (2FA) adds a layer of security to your accounts by requiring a second form of identification.

Benefits of 2FA:

- Extra Layer of Protection: Prevents unauthorized access, even if someone has your password.

- Time-Sensitive Codes: Most 2FA systems use temporary codes sent to your mobile device.

- Device-Specific Access: Some 2FA systems require recognition of specific devices.

3. What Are the Risks of Public Wi-Fi for Account Security?

Using public Wi-Fi can expose your account information to potential attackers. Here’s how to minimize the risks:

Public Wi-Fi Tips:

- Avoid Sensitive Transactions: Don’t access bank accounts or personal information on public Wi-Fi.

- Use a VPN: A Virtual Private Network (VPN) encrypts your data, making it more secure.

- Enable Firewall: Turn on your device’s firewall for extra protection.

4. How Can I Secure My Account Through Regular Monitoring?

Account monitoring is essential for detecting suspicious activity early on.

Monitoring Strategies:

- Check Login Activity: Many platforms let you review recent login locations.

- Enable Notifications: Get alerts for login attempts, password changes, and unusual activities.

- Review Account Statements: Regularly review financial statements to catch unauthorized transactions.

5. Why Is It Important to Update Software and Apps?

Keeping software up to date helps close security loopholes that hackers exploit.

Updating Practices:

- Enable Auto-Updates: Set software to update automatically to ensure you’re protected.

- Patch Security Bugs: Developers frequently patch security vulnerabilities in updates.

- Update All Devices: Ensure all devices you use to access accounts are updated.

6. What Are Secure Browsing Practices for Account Safety?

Browsing securely reduces exposure to potential cyber threats and keeps your account safe.

Browsing Tips:

- Use HTTPS: Only browse on websites with HTTPS for a secure connection.

- Avoid Suspicious Links: Don’t click on links from unknown sources, as they may contain malware.

- Clear Cache Regularly: Clearing your cache helps maintain privacy.

7. How Do Backup Codes Work in Account Security?

Backup codes act as a failsafe if you lose access to your primary 2FA method.

Using Backup Codes:

- Store Codes Safely: Keep them in a secure place, such as a password manager.

- Limit Usage: Only use backup codes when absolutely necessary.

- Regenerate as Needed: Most platforms allow you to create new codes periodically.

8. Why Should I Use a Password Manager?

A password manager securely stores and organizes all your passwords.

Password Manager Advantages:

- Secure Storage: Stores complex passwords in an encrypted format.

- One Master Password: Remember only one password to access all others.

- Auto-Generation: Many managers can generate complex passwords for you.

9. What Are Phishing Attacks and How Can I Avoid Them?

Phishing attacks trick users into giving away sensitive information.

Preventing Phishing:

- Verify Email Sender: Check the email address and verify authenticity.

- Don’t Click Unknown Links: Avoid links from unknown or untrusted sources.

- Enable Anti-Phishing Tools: Many email providers offer tools to filter phishing attempts.

10. How Does Biometric Security Strengthen Account Protection?

Biometrics, like fingerprint or facial recognition, add a unique layer of security.

Biometric Benefits:

- Unique Identification: Biometrics are unique to each individual, making them harder to replicate.

- Quick and Convenient: Fast access without needing to remember passwords.

- Enhanced Security: Often combined with passwords for multi-factor authentication.

Summary Table

| Security Method | Description | Benefit |

|---|---|---|

| Password Practices | Using complex, unique, and lengthy passwords | Stronger protection against brute-force attacks |

| Two-Factor Authentication | Requires a second verification method | Blocks unauthorized access |

| Secure Browsing | Using HTTPS and avoiding suspicious sites | Reduces malware and phishing risks |

| Biometric Security | Fingerprint or facial recognition | Unique and convenient identification |

Frequently Asked Questions (FAQ)

1. How can I make my password more secure?

Use a combination of uppercase letters, lowercase letters, numbers, and special characters. Avoid common words and create unique passwords for each account.

2. What should I do if I lose my two-factor authentication device?

Use backup codes provided by the account service, or try a secondary recovery option if available.

3. Are public Wi-Fi networks safe for banking?

It’s best to avoid accessing sensitive accounts over public Wi-Fi. If necessary, use a VPN for added protection.

4. How often should I check my account activity?

Regularly monitoring login history and transaction details, especially for financial accounts, is recommended to catch suspicious activity early.

5. Why is updating software important for security?

Updates fix vulnerabilities that could allow unauthorized access or malware infections.

6. Can I store my passwords in a browser?

While convenient, storing passwords in a browser may be less secure than a dedicated password manager.

7. How do I recognize phishing attempts?

Check for suspicious email addresses, poor spelling or grammar, and generic greetings. Avoid clicking on unverified links.