How to Recognize Investment Fraud: Key Questions and Guidance

1. What are the Warning Signs of Investment Fraud?

Investment fraud can be challenging to recognize at first glance, but there are clear warning signs to look out for. Recognizing these red flags can help protect you from potential scams. This section outlines the major warning signs and how to evaluate suspicious investment opportunities.

- High Returns with Low Risk: Promises of unusually high returns with minimal or no risk are often a sign of fraud. Genuine investments carry some level of risk.

- Pressure to Act Quickly: Scammers may push you to make quick decisions. Take your time to research any investment thoroughly.

- Lack of Transparency: Avoid investments where the details are not clear or fully disclosed.

- Unlicensed Sellers: Legitimate investment sellers are registered with regulatory bodies. Check the credentials of anyone offering an investment.

2. How Can I Verify If an Investment is Legitimate?

Verifying the legitimacy of an investment is essential before committing any funds. Here are some actionable steps you can take to ensure that an investment is trustworthy.

- Research the Company: Look up the company’s history, reviews, and registration with regulatory bodies.

- Check Credentials: Verify that the financial advisors or brokers are licensed professionals.

- Understand the Business Model: Ensure you fully understand how the investment generates returns.

- Consult Reputable Sources: Seek information from trustworthy financial websites and official government sources.

3. Why Do People Fall for Investment Scams?

Understanding the psychological tactics used by scammers can help you avoid falling victim to investment fraud. Scammers often use these common tactics to deceive investors:

- Appeal to Greed: Scammers offer high returns to attract investors driven by the desire for fast profits.

- Exploiting Trust: Scammers may pretend to be affiliated with reputable companies or organizations.

- Creating a Sense of Urgency: By pressuring investors to act fast, scammers prevent thorough decision-making.

- Building Credibility: Scammers often use complex jargon and fake testimonials to appear legitimate.

4. What Are Common Types of Investment Fraud?

Investment fraud can take many forms, each with unique characteristics. Below are some of the most common types:

| Type of Fraud | Description |

|---|---|

| Ponzi Schemes | Scammers use funds from new investors to pay returns to earlier investors. |

| Pyramid Schemes | Participants earn money by recruiting new members, rather than through legitimate investments. |

| Advance Fee Schemes | Victims are required to pay fees upfront for promised returns or services that never materialize. |

| Pump and Dump | Fraudsters inflate stock prices through false information, then sell off shares at a profit. |

5. How to Report Suspected Investment Fraud?

Reporting investment fraud promptly can help authorities investigate and potentially recover lost funds. Follow these steps if you suspect fraud:

- Document Evidence: Gather all records, emails, and documents related to the investment.

- Report to Authorities: Contact your country’s financial regulatory agency, such as the SEC in the United States.

- Contact Law Enforcement: File a report with local law enforcement if the fraud occurred locally.

- Use Online Reporting Tools: Many regulatory bodies have online forms for reporting fraud cases.

6. How Can I Protect Myself from Investment Fraud?

Protecting yourself from investment fraud requires vigilance and knowledge. Here are some strategies to avoid scams:

- Research Before Investing: Always thoroughly research any investment opportunity.

- Verify Credentials: Check the credentials of financial advisors or brokers before engaging with them.

- Understand Risks: Be cautious of any investment that promises guaranteed returns.

- Stay Updated: Educate yourself about common scams to be better prepared.

7. What Steps Can I Take to Recover from Investment Fraud?

If you’ve fallen victim to investment fraud, there are steps you can take to attempt recovery:

- Contact Your Bank: Immediately notify your bank or financial institution of any fraudulent activity.

- Report the Fraud: Report the incident to regulatory authorities and law enforcement.

- Seek Legal Assistance: Consider consulting a legal expert specializing in financial fraud.

- Check for Victim Assistance Programs: Some countries offer assistance programs for fraud victims.

8. How Do Ponzi and Pyramid Schemes Differ?

Ponzi and pyramid schemes are two common types of fraud. This table outlines their differences:

| Feature | Ponzi Scheme | Pyramid Scheme |

|---|---|---|

| Income Source | New investors’ funds | Participants earn by recruiting others |

| Structure | Single individual or company manages funds | Many levels of participants involved |

| Legitimacy | Often appears as a legitimate investment | Involves direct recruitment, usually less disguised |

9. Why is it Important to Educate Yourself About Investment Fraud?

Education is a powerful tool against investment fraud. Here’s why knowledge is essential:

- Prevents Loss: Knowledge helps you spot scams early, reducing financial losses.

- Empowers Decision-Making: Being informed enables better investment decisions.

- Promotes Financial Security: Understanding fraud helps protect your wealth over time.

- Encourages Responsible Investing: Knowledgeable investors avoid risky, high-return scams.

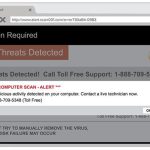

10. Are Online Investments More Prone to Fraud?

Online investments, while convenient, can expose investors to higher risks of fraud. Here are some tips to avoid online investment scams:

- Research Platforms: Only use reputable platforms with positive reviews and security measures.

- Avoid Unsolicited Offers: Be wary of unexpected messages offering investments.

- Use Secure Payment Methods: Use reliable payment options to avoid compromising your financial details.

- Verify Authenticity: Double-check the legitimacy of digital platforms before investing.

Summary Table

| Question | Key Points |

|---|---|

| Warning Signs of Investment Fraud | High returns, pressure tactics, lack of transparency, unlicensed sellers |

| How to Verify Investment Legitimacy | Research company, check credentials, understand business model |

| Why People Fall for Scams | Appeal to greed, trust exploitation, urgency tactics, fake credibility |

| Common Types of Investment Fraud | Ponzi schemes, pyramid schemes, advance fee scams, pump and dump |