Understanding Hidden Fees: A Guide to Identifying and Avoiding Unexpected Costs

What Are Common Signs of Hidden Fees?

Hidden fees can turn a seemingly affordable service or product into a financial burden. Recognizing these extra costs before they impact your wallet is crucial. Here’s a breakdown of the most common indicators of hidden fees and tips to avoid them.

1. Unclear or Vague Terms

One of the primary signs of hidden fees is vague language in the contract or terms of service. Phrases like “additional costs may apply” or “subject to fees” without specific amounts can signal hidden charges.

2. Extra Fees at Checkout

If unexpected fees appear during the checkout process, such as “convenience charges” or “processing fees,” you may be encountering hidden fees. Make sure to carefully review each line item before completing a transaction.

3. Recurring Charges Without Clear Disclosure

Hidden fees often appear in the form of recurring charges that weren’t disclosed upfront. Subscriptions, memberships, or trial periods that automatically renew are common sources of these fees.

4. Service Fees Listed Separately

Companies sometimes break down their charges into separate categories to make the base price appear lower. For instance, “facility fees” or “convenience charges” are commonly used in ticketing and travel services.

5. Processing or Administrative Fees

Administrative fees are common with loans, credit cards, and financial services. If you see terms like “account maintenance” or “service processing,” these may be signs of hidden costs.

6. Shipping and Handling Costs

Many e-commerce platforms and online retailers add shipping and handling fees that can be much higher than anticipated. Always review shipping costs in the final stages of purchase to avoid surprise fees.

7. Cancellation Fees

Certain services impose cancellation fees that weren’t explicitly mentioned during signup. Check cancellation policies before committing to any new service to avoid these potential charges.

8. Additional Fees for Preferred Payment Methods

Some merchants may charge extra fees for specific payment types, like credit cards or PayPal. Look for these additional fees, particularly in online stores or service providers.

9. Activation or Installation Fees

Cable companies, internet providers, and utility services often charge activation or installation fees. These are sometimes hidden within service agreements or initial invoices.

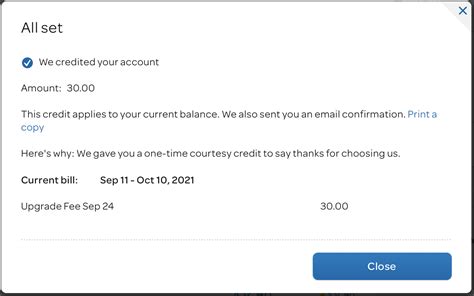

10. “Free Trial” Offers with Hidden Conditions

“Free trial” offers can carry hidden fees if you’re not careful. Often, these trials auto-renew into paid subscriptions if they aren’t canceled on time, resulting in unexpected charges.

Table Summarizing Common Hidden Fees

| Hidden Fee Type | Description | Example |

|---|---|---|

| Vague Terms | Unclear or vague wording in terms | “Additional charges may apply” |

| Checkout Fees | Unexpected charges added at checkout | Processing or handling fees |

| Recurring Charges | Auto-renewed subscriptions or memberships | Monthly service fee after trial |

| Service Fees | Separate service-related fees | Facility or convenience fees |

| Cancellation Fees | Fees for canceling a service | Cancellation charge for subscription |

FAQ

1. How do I avoid hidden fees in subscriptions?

To avoid hidden fees in subscriptions, check for clear information about renewal policies, cancellation terms, and any associated fees before committing.

2. Why are hidden fees common in travel bookings?

Travel bookings often include hidden fees like “resort fees” or “convenience charges” due to the way travel agencies and providers structure pricing. Reviewing each component of the final price helps in avoiding these fees.

3. What are activation fees, and can they be waived?

Activation fees are charges for initiating a service, common in utilities or cable services. Sometimes, providers can waive these fees upon request or during promotions.

4. Are cancellation fees legal?

Yes, cancellation fees are typically legal if disclosed in the service terms. Review the cancellation policies to understand any potential fees associated with terminating a service.

5. How do processing fees work?

Processing fees cover the administrative costs of handling transactions. They’re often a percentage of the transaction and may appear during checkout.

6. Are handling fees refundable?

Handling fees are often non-refundable, especially in e-commerce or ticketing. However, check the refund policy to confirm specific terms.

7. What is a “convenience fee” in online payments?

A convenience fee is a charge for using a specific payment method, such as credit cards or online payment services. Not all transactions have this fee, but some merchants apply it as a handling cost.