10 of the Most Successful Legal Fraud Cases in History

1. What Was Enron’s Fraud Scandal and How Was It Exposed?

The Enron scandal, one of the largest fraud cases in history, involved the manipulation of financial records by Enron executives. The company hid debt and fabricated profits, misleading investors. In 2001, Enron’s elaborate scheme was unveiled, leading to its bankruptcy.

Enron executives, including Jeffrey Skilling and Kenneth Lay, orchestrated this fraud by using mark-to-market accounting, allowing them to count potential profits from projects that hadn’t even generated revenue. This inflated Enron’s value significantly.

Here’s a summary of Enron’s scandal timeline:

| Year | Event |

|---|---|

| 2000 | Enron ranked by Fortune as “America’s Most Innovative Company.” |

| 2001 | Financial scandal exposed; bankruptcy follows. |

| 2006 | Executives found guilty of fraud and conspiracy. |

The Enron case led to the Sarbanes-Oxley Act, increasing corporate accountability and transparency.

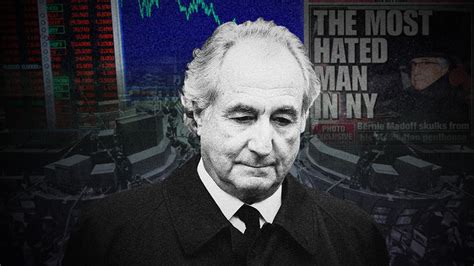

2. How Did Bernie Madoff Pull Off the Largest Ponzi Scheme in History?

Bernie Madoff’s Ponzi scheme defrauded investors out of billions by using funds from new investors to pay returns to earlier investors. The scheme collapsed in 2008, leaving thousands of victims and sparking massive legal actions.

Madoff’s fraudulent success stemmed from his reputation on Wall Street. He provided consistently high returns that appeared too good to be true. His downfall came during the financial crisis, as more investors attempted to withdraw funds than he could replace.

Here’s a look at key details of Madoff’s scheme:

- Investment Amount: Estimated at $65 billion.

- Victims: Individual investors, charities, financial institutions.

- Sentencing: Madoff was sentenced to 150 years in prison.

3. What Was the Outcome of the WorldCom Fraud Case?

WorldCom, a telecommunications company, engaged in fraudulent accounting practices, hiding $3.8 billion in expenses to inflate its profits. The fraud was discovered in 2002, leading to WorldCom’s bankruptcy, which was one of the largest at that time.

The fraud involved reallocating regular expenses as capital expenses, allowing WorldCom to avoid reporting them on their profit-and-loss statement. When this came to light, the company’s stock plummeted, and it filed for bankruptcy.

The aftermath of the WorldCom scandal emphasized the need for strict financial regulation in publicly traded companies.

4. How Did Theranos and Elizabeth Holmes Deceive Investors and Patients?

Theranos, founded by Elizabeth Holmes, claimed to revolutionize blood testing with a device that could run hundreds of tests using just a few drops of blood. However, the technology was unproven and ultimately failed to deliver accurate results.

Holmes and former COO Ramesh “Sunny” Balwani were later charged with fraud. The case highlighted the dangers of unchecked startup hype and led to a re-evaluation of due diligence in venture capital.

5. What Were the Consequences of the Wells Fargo Fake Accounts Scandal?

In 2016, Wells Fargo admitted that employees had created millions of unauthorized accounts without customer consent. This was due to an aggressive sales culture that encouraged employees to meet high sales targets by any means.

Wells Fargo’s reputation took a hit, and the company faced significant fines. Executives resigned, and the company’s practices became a focal point in debates over ethical banking.

6. How Did HealthSouth’s Richard Scrushy Manipulate Earnings?

Richard Scrushy, CEO of HealthSouth, inflated company earnings by nearly $1.4 billion in order to meet Wall Street expectations. The scheme involved false financial statements and manipulation of the company’s books.

The fraud was eventually exposed, leading to major reforms in the healthcare sector’s reporting standards.

7. What Happened in the Volkswagen Emissions Scandal?

Volkswagen admitted to installing software in diesel vehicles to cheat emissions tests. This “defeat device” allowed vehicles to pass tests while emitting pollutants well above the legal limits.

The scandal cost Volkswagen billions in fines and damaged the company’s image significantly.

8. How Did Wirecard’s Financial Scandal Unfold?

Wirecard, a German payment processor, was found to have inflated its balance sheet by €1.9 billion. The missing funds could not be accounted for, and Wirecard eventually filed for insolvency in 2020.

This case underscored the importance of transparency and effective auditing in financial institutions.

9. How Did Fyre Festival Fraud Unfold?

Fyre Festival, promoted as a luxury music festival, turned out to be a disaster with subpar conditions. Founder Billy McFarland was later charged with fraud for misleading investors and attendees about the event’s capabilities.

10. What Were the Implications of the Herbalife Pyramid Scheme Allegations?

Herbalife faced accusations of operating a pyramid scheme, as the business model relied heavily on recruitment rather than product sales. Although Herbalife settled with the FTC, it had to restructure its business practices.

Summary of Successful Legal Fraud Cases

| Fraud Case | Key Players | Outcome |

|---|---|---|

| Enron | Jeffrey Skilling, Kenneth Lay | Bankruptcy, prison sentences, reforms |

| Bernie Madoff | Bernie Madoff | 150 years in prison |

| WorldCom | Bernard Ebbers | Bankruptcy, financial regulation |

Frequently Asked Questions (FAQ)

What is the biggest corporate fraud case in history?

Enron is often cited as one of the largest corporate fraud cases in history.

How did Bernie Madoff manage to avoid detection for so long?

Madoff maintained a good reputation, which prevented scrutiny and masked his Ponzi scheme.