How to Identify and Avoid Counterfeit Allianz Travel Insurance

1. What are the Common Signs of Counterfeit Allianz Travel Insurance?

Counterfeit travel insurance policies can lead to significant financial and personal issues, especially when traveling internationally. Allianz, as a leading travel insurance provider, has a strong reputation, making it a target for fraudsters. Recognizing the warning signs of a fake Allianz travel insurance policy is essential to avoid problems later.

One of the most telling signs of counterfeit Allianz travel insurance is an unusually low premium cost. Scammers may offer very cheap insurance rates to attract potential customers. If a deal seems too good to be true, it probably is. Always compare prices with official Allianz or trusted insurance providers to avoid such traps.

Another indicator is the lack of contact information or misspelled information on the insurance documents. Genuine Allianz policies will include accurate contact details and correct branding. A fake policy may have errors in the logo, brand name, or even the customer service number, making it difficult to reach Allianz directly.

Check for grammatical errors or formatting inconsistencies within the policy documents. Allianz’s official documents are professionally crafted and free from errors. A poorly formatted or unprofessional-looking document may indicate counterfeit insurance.

A fake Allianz policy might also lack specific coverage details. Real policies from Allianz will explicitly outline what is covered, including maximum payout amounts and exclusions. If your policy lacks these details or appears vague, it may be a red flag.

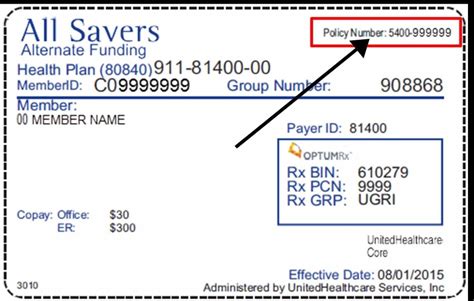

Sometimes, counterfeit policies lack a valid policy number or include a fake one. Allianz policies come with a unique, traceable policy number that can be verified through their official channels. Suspicious or missing policy numbers are strong indicators of counterfeit insurance.

Unusual payment methods or a lack of payment receipts can also signify fraud. Allianz typically uses secure payment gateways and provides official receipts. If you’re directed to pay through untraceable methods, such as cash, it’s likely a scam.

Inspect the document seal and signature. Genuine Allianz policies include official seals and authorized signatures. Counterfeit policies often lack these or have illegible, blurry, or fake signatures, signaling fraud.

Policy expiration dates should align with your travel dates. Scammers might overlook this detail, issuing policies with mismatched dates. Double-check these to ensure they’re correct.

Finally, seek out reviews and research the source of the policy. If the policy came from a questionable website or third-party seller with negative reviews, it might be fake. Trusted Allianz agents or the official Allianz website are the safest places to purchase authentic travel insurance.

2. How Can I Verify if My Allianz Policy Number is Genuine?

Verifying the authenticity of your Allianz policy number is a straightforward yet crucial step in confirming your policy’s legitimacy. Allianz offers several resources to help you cross-check and ensure your policy is genuine.

The most reliable way to verify your Allianz policy number is by visiting Allianz’s official website and using their verification tools. Many insurance companies provide online portals where you can input your policy number and immediately confirm its validity.

If your policy was purchased through a licensed Allianz agent, contact them to confirm the policy details. Licensed agents can directly access Allianz’s system and provide you with the necessary verification.

Allianz’s customer service team is another valuable resource. By calling their official customer service number, you can speak to a representative who will verify your policy number and confirm if it’s valid.

Additionally, some Allianz mobile apps allow policyholders to check policy numbers and status. These official apps are secure and offer a quick way to verify your policy on the go.

Another option is to check the policy documents’ QR code, if available. Scanning the code with a smartphone can lead you directly to the Allianz site, where you can confirm the policy’s authenticity.

Ensure that the policy number format matches Allianz’s usual format. Many fake policies use random numbers or incorrect formats that do not align with Allianz’s official numbering system.

If the policy number verification fails or shows as invalid, it’s essential to contact Allianz directly for clarification. They can guide you on the next steps and confirm if the policy is genuine or not.

Checking payment records is also helpful. A genuine Allianz policy will have a corresponding payment record in your bank account, with a clear transaction description.

Finally, always retain receipts, emails, or messages from Allianz or your agent confirming the policy purchase. These documents serve as proof and can help validate your policy if there’s ever a question about its legitimacy.