Understanding Legal Fraud: Tactics, Strategies, and Safeguards

1. What is Legal Fraud and How Does It Differ from Other Forms of Fraud?

Legal fraud refers to deceptive practices or intentional manipulation within the confines of the law. Unlike blatant illegal fraud, which violates criminal laws, legal fraud often exploits loopholes, ambiguities, or gray areas in legislation. These tactics aim to deceive or mislead while technically staying within the boundaries of legality.

Legal fraud can include practices such as false advertising, unfair contract terms, and misrepresentation. While not always criminal, these acts are often unethical and can result in civil suits or penalties.

- False Advertising: Misleading consumers about the benefits or quality of a product.

- Contractual Misrepresentation: Including terms that are unfair or difficult to understand, trapping individuals in unfavorable agreements.

- Exploiting Legal Loopholes: Using ambiguities in law to justify unethical actions.

Legal fraud can be challenging to prove because it doesn’t involve clear-cut violations of criminal laws. The burden of proof often lies on the plaintiff, who must demonstrate deception or misrepresentation beyond what is legally permissible.

2. What Tactics Are Commonly Used in Legal Fraud?

Legal fraud tactics often take advantage of the complexities and intricacies of law. Individuals or entities that engage in legal fraud are typically well-versed in legal jargon and the gray areas of statutes. Below are some common tactics used in legal fraud:

- Ambiguous Contract Terms: Deliberately including vague or unclear terms in contracts that can be interpreted in multiple ways, favoring one party over another.

- Misrepresentation of Facts: Falsely representing information in a way that misleads the other party into agreeing to something they might not have otherwise.

- Overcomplicated Legal Documents: Making agreements so complex that the average person is unable to fully comprehend them, leading to unintended consequences.

These tactics are designed to confuse, mislead, or disadvantage the other party, and while they may be technically legal, they are often seen as unethical. Victims of legal fraud may have recourse through civil litigation, but proving deception in these cases can be difficult.

3. How Can Individuals Protect Themselves from Legal Fraud?

Preventing legal fraud involves being vigilant and taking steps to safeguard your interests. Here are several ways individuals can protect themselves from falling victim to legal fraud:

- Read Contracts Thoroughly: Never sign a contract without thoroughly reading and understanding it. If there’s any ambiguity, seek legal advice before agreeing.

- Consult a Lawyer: Having a legal professional review documents can help you identify any potential issues or unfair terms.

- Research the Parties Involved: Always perform due diligence on the individuals or companies you are dealing with to ensure they have a trustworthy reputation.

Being aware of the common tactics used in legal fraud is a crucial first step. Additionally, ensuring that you document everything and get all agreements in writing can help you defend your position in case of any disputes.

4. What Role Does Technology Play in Legal Fraud?

Technology has opened new avenues for legal fraud, especially with the rise of digital contracts, online transactions, and complex algorithms. Here’s how technology can be manipulated in legal fraud:

- Online Scams: Fraudsters use fake websites, phishing emails, and other digital tools to mislead consumers and businesses.

- Automated Contract Generation: Using automated systems to create contracts that are difficult to understand and can trap individuals in unfair agreements.

- Data Manipulation: Misrepresenting financial or personal data to deceive others in business deals.

Technology has made it easier for fraudsters to exploit legal loopholes. As a result, individuals and businesses must remain vigilant, particularly when engaging in online transactions or digital contracts.

5. How Does Corporate Fraud Use Legal Tactics?

Corporate fraud often involves manipulating financial data, misleading shareholders, or exploiting loopholes in business regulations. Legal tactics employed in corporate fraud include:

- Insider Trading: Using confidential information to gain an unfair advantage in the stock market.

- Misleading Financial Reporting: Falsifying financial statements to make a company appear more profitable than it is.

- Tax Evasion: Exploiting tax law loopholes to reduce a company’s tax liability illegally.

Corporate fraud not only harms investors but can also damage the broader economy. Legal loopholes are often exploited in ways that make it difficult to hold the perpetrators accountable, although regulatory agencies continue to tighten their oversight.

6. What Legal Safeguards Exist to Protect Against Fraud?

Various legal safeguards are in place to protect individuals and businesses from fraud. These include:

- Consumer Protection Laws: These laws aim to shield consumers from unfair practices and deceptive advertising.

- Financial Regulations: Regulatory agencies like the Securities and Exchange Commission (SEC) monitor corporate activities to prevent fraud.

- Anti-Fraud Legislation: Specific laws are in place to prosecute fraudsters, such as the Anti-Fraud Act.

While these laws help protect the public, the complexity of legal fraud means that enforcement can sometimes be difficult. The key is to remain proactive and seek legal advice if you believe you’ve been a victim of fraud.

7. How Do Scammers Use Legal Jargon to Commit Fraud?

Scammers often use complex legal language to confuse or mislead their targets. By making agreements sound official or overwhelming, they can manipulate individuals into agreeing to unfair terms. Some common examples include:

- Unfamiliar Terms: Using legal jargon that the average person doesn’t understand.

- Overloading with Information: Including excessive, unnecessary details to make contracts appear more legitimate.

- Exploiting Trust: Scammers often pose as legal professionals to gain trust.

Understanding basic legal terms and consulting a professional when in doubt are key strategies to avoid falling victim to this type of fraud.

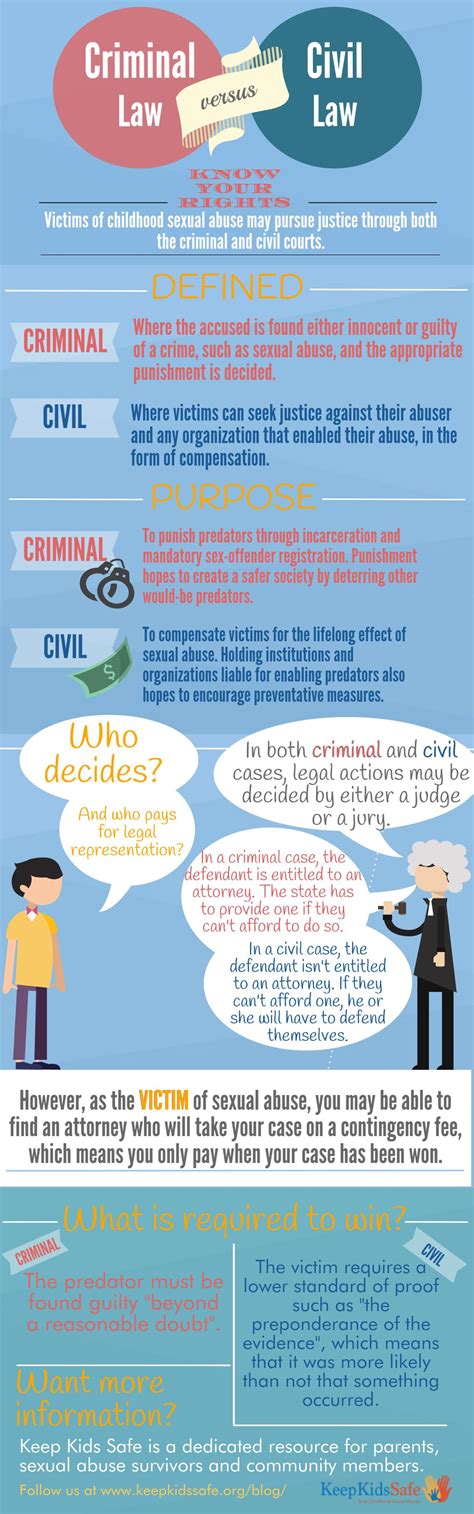

8. What Is the Difference Between Civil and Criminal Fraud?

The key difference between civil and criminal fraud is the nature of the legal proceedings. Civil fraud typically involves disputes between individuals or businesses, whereas criminal fraud involves actions that are illegal under criminal law. Some differences include:

| Aspect | Civil Fraud | Criminal Fraud |

|---|---|---|

| Burden of Proof | Preponderance of evidence | Beyond a reasonable doubt |

| Punishments | Fines, damages | Imprisonment, fines |

Understanding the differences between these two types of fraud is important when seeking legal recourse, as the standards and outcomes differ significantly.

9. Can Legal Fraud Occur in Family Law?

Yes, legal fraud can occur in family law, particularly in divorce settlements, child custody cases, and prenuptial agreements. Some examples include:

- Concealing Assets: Hiding financial assets to avoid sharing them in divorce settlements.

- Falsifying Evidence: Providing false information to gain an advantage in child custody cases.

- Coercive Agreements: Forcing a spouse to sign an unfavorable prenuptial agreement under duress.

Legal fraud in family law cases can have long-lasting consequences, impacting finances, custody arrangements, and overall well-being. It’s essential to have proper legal representation in such cases to avoid becoming a victim.

10. What Are the Legal Ramifications of Being Involved in Legal Fraud?

Being involved in legal fraud, whether as a perpetrator or a victim, can have serious consequences. For perpetrators, the consequences may include:

- Civil Lawsuits: Victims can sue for damages if they’ve been defrauded.

- Criminal Charges: In cases where fraud crosses into illegal activity, criminal charges may be brought.

- Reputation Damage: Being associated with legal fraud can have long-term consequences on an individual or company’s reputation.

For victims, the legal process can be long and costly, but pursuing justice is often necessary to recover lost assets or correct unfair agreements.

Table Summary of Key Points

| Tactic | Description | Example |

|---|---|---|

| False Advertising | Misleading claims about products | Claims a product cures diseases without evidence |

| Ambiguous Contract Terms | Unclear contract language | Contracts that can be interpreted in multiple ways |

| Corporate Fraud | Manipulating financial data | Falsifying financial statements |

FAQs

1. What are common signs of legal fraud?

Some signs include ambiguous contract terms, complex legal language, and misrepresentation of facts.

2. Can a victim of legal fraud take legal action?

Yes, victims can pursue civil litigation or, in some cases, criminal charges.

3. How can I avoid being a victim of legal fraud?

Always read contracts thoroughly, seek legal advice, and research the other party involved.

4. What should I do if I suspect legal fraud?

Consult a lawyer immediately to assess the situation and explore legal options.

5. How do legal loopholes contribute to legal fraud?

Fraudsters exploit ambiguities in law to deceive others while avoiding criminal penalties.

6. Can businesses be held accountable for legal fraud?

Yes, businesses can face civil lawsuits and regulatory penalties for engaging in legal fraud.

7. What is the difference between a scam and legal fraud?

A scam is usually outright illegal, while legal fraud operates within legal gray areas but is still deceptive.