Why Are Nigerian Prince Scams So Common?

What is a Nigerian Prince Scam, and How Does It Work?

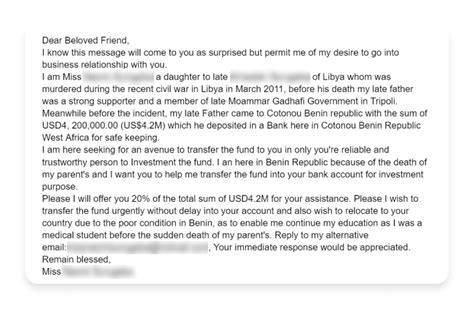

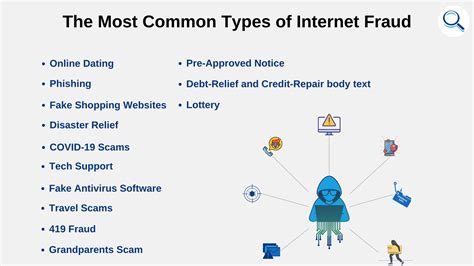

The “Nigerian Prince” scam, also known as a 419 scam (named after the Nigerian Criminal Code dealing with fraud), is a form of advance-fee fraud. Scammers promise substantial financial gains to the victim in exchange for a small upfront payment. The story typically involves an exiled Nigerian prince, a large inheritance, and the need for immediate financial assistance to release these funds.

This type of scam usually begins with an unsolicited email in which the scammer claims to be a member of Nigerian royalty or someone with access to a large sum of money. They request help in transferring the funds out of Nigeria, promising a hefty share of the amount in return. To complete the transfer, the “prince” requires the recipient to cover various fees, which are often explained as legal, bank transfer, or tax fees.

After the initial payment, scammers continue asking for additional amounts until the victim either realizes the scam or runs out of money. Here is how the process typically works:

- **Step 1:** Initial Contact – The scammer sends an email or message introducing themselves as a wealthy individual needing help.

- **Step 2:** Promise of Riches – They promise a substantial reward for your cooperation.

- **Step 3:** Request for Assistance – You’re asked to pay a “small fee” to help release the funds.

- **Step 4:** Additional Costs – Fees keep piling up, and the victim is asked for more payments.

- **Step 5:** Realization – Many victims realize they’ve been scammed once they’ve paid multiple fees.

Understanding the structure and methods of Nigerian prince scams can help protect individuals from falling prey to similar tactics.

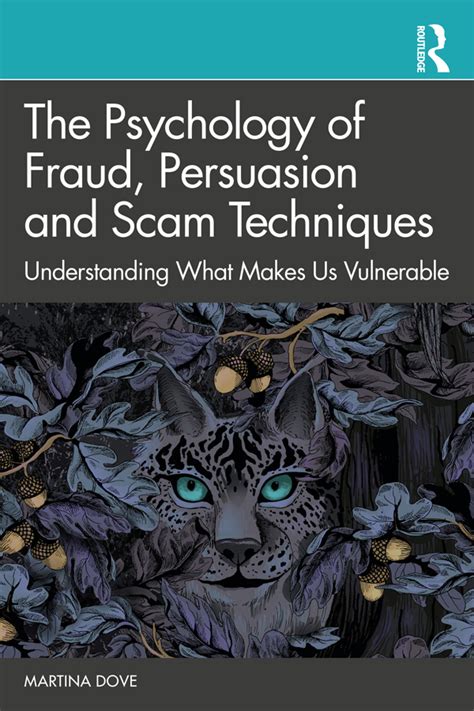

Why Do People Fall for Nigerian Prince Scams?

Victims often fall for Nigerian prince scams because the scammers exploit psychological tactics and vulnerabilities. Here are several reasons why individuals continue to fall prey to these scams:

- **Emotional Appeal**: The scam’s story often appeals to individuals’ emotions, creating a sense of urgency and personal connection.

- **Financial Desperation**: People in financial distress may overlook red flags in the hope of a life-changing sum of money.

- **Greed and Curiosity**: The promise of a quick financial reward can cloud judgment.

- **Lack of Internet Awareness**: Individuals unfamiliar with online scams are more likely to trust emails and messages from unknown sources.

- **Consistency in Tactics**: Scammers have honed their methods, continually refining their approach to be more convincing.

The psychological factors at play in Nigerian prince scams are powerful, often tapping into basic human desires and fears.

What Makes Nigerian Prince Scams So Effective?

Despite being widely known, Nigerian prince scams remain effective due to several key factors. Below is a table summarizing these points:

| Factor | Explanation |

|---|---|

| Psychological Appeal | Scammers create urgency and a sense of connection. |

| Lack of Knowledge | Those unaware of scams are more susceptible. |

| Simple Format | Emails appear personal and straightforward. |

| Global Reach | Emails can be sent to millions worldwide. |

The factors listed contribute to the continued success of Nigerian prince scams, despite increased awareness and warnings.

How Have Nigerian Prince Scams Evolved Over Time?

Originally, Nigerian prince scams were simple, poorly written emails. However, they have evolved significantly over the years:

- **Improved Language**: Scammers now use more sophisticated language, reducing grammatical errors.

- **Advanced Social Engineering**: They leverage detailed stories and sometimes mimic real-world events.

- **Expanded Channels**: Scammers now use social media, text messages, and even phone calls.

- **Targeting Businesses**: Scams now include “business email compromise” schemes targeting corporate executives.

As these scams evolve, they become more difficult to detect, especially for individuals who may not be familiar with the new tactics.

What Are the Legal Repercussions for Perpetrators of Nigerian Prince Scams?

Nigerian prince scams violate several laws, and offenders face serious legal consequences. In Nigeria, scammers are subject to the following penalties:

- **Nigerian Criminal Code**: Fraudulent activities are punishable under Section 419.

- **International Collaboration**: Countries collaborate through Interpol and other organizations to prosecute scammers.

- **Asset Forfeiture**: In cases of large fraud operations, assets are seized.

While there are efforts to prosecute offenders, enforcement can be challenging due to jurisdictional issues and the cross-border nature of these crimes.

How Can Individuals Protect Themselves Against Nigerian Prince Scams?

To avoid falling victim to Nigerian prince scams, follow these protection tips:

- **Ignore Unsolicited Emails**: If an email appears suspicious, don’t respond.

- **Verify Sources**: Check the credibility of any sender claiming to offer financial rewards.

- **Educate Yourself**: Understanding common scam tactics is key to avoidance.

- **Use Spam Filters**: Many email providers offer filters that can block such messages.

Following these tips can help minimize the chances of becoming a victim of online scams.

Are Nigerian Prince Scams Only Limited to Emails?

While email is the primary medium, Nigerian prince scams have expanded to other platforms:

- **Social Media**: Scammers contact individuals through social networks.

- **SMS and Messaging Apps**: Text messages are becoming a common medium.

- **Phone Calls**: Some scammers use phone calls to lend a personal touch.

This shift in platforms makes it even more important for individuals to stay vigilant across various channels.

Why Are Nigerian Prince Scams Mostly Associated with Nigeria?

The association with Nigeria in these scams originates from various reasons, including:

- **Historical Origins**: Some of the earliest scams came from Nigeria, leading to the term “Nigerian prince.”

- **Prevalence of Scams**: Due to a high volume of scam emails, Nigeria is often linked to these schemes.

- **Stereotyping**: The “Nigerian prince” scam has become a stereotype in internet culture.

While scammers can be from anywhere, the association with Nigeria has persisted due to its historical roots.

Can Law Enforcement Track Down Nigerian Prince Scammers?

Tracking down scammers can be difficult, but law enforcement agencies employ these methods:

- **International Cooperation**: Agencies collaborate to track cross-border scams.

- **Cybersecurity Measures**: Advanced cybersecurity tools help identify scam sources.

- **Public Awareness Campaigns**: Education helps reduce victim numbers.

Despite these efforts, the anonymity of the internet presents significant challenges in apprehending scammers.

Are Nigerian Prince Scams Targeted at Certain Demographics?

Nigerian prince scams often target individuals who might be more vulnerable:

- **Elderly**: Older adults are frequently targeted due to unfamiliarity with digital scams.

- **Financially Desperate**: Individuals in financial distress are also common targets.

- **Less Tech-Savvy Individuals**: People with limited internet experience are more susceptible.

Understanding which demographics are targeted can help in creating more effective awareness and prevention campaigns.

Summary Table

| Question | Key Points |

|---|---|

| What is a Nigerian Prince Scam? | Advance-fee fraud promising large financial rewards. |

| Why Do People Fall for These Scams? | Emotional appeal, lack of awareness, financial need. |

| How Can Individuals Protect Themselves? | Ignore suspicious emails, verify sources, use spam filters. |

| Is Law Enforcement Involved? | International collaboration, cybersecurity, public awareness. |